WHEN BUYING PROPERTY OWNED BY A COMPANY, SHOULD I PURCHASE THE COMPANY’S SHARES OR THE PROPERTY ITSELF?

For many of us, the opportunity to buy a house is quite an exciting prospect – but then the owner comes with alternative options or proposals to purchase the property – a different option of which you know very little, but of which the benefits sound almost too good to be true. The possibility to save on both costs and time!

The perception exists that:

“If the property is registered in the name of a Company or Close Corporation (CC) and you purchase the shares or member’s interest (whatever the case might be) you will be exempted from paying transfer duty”.

We will briefly discuss if it is indeed beneficial to consider this option:

There is a general belief that you don’t have to pay transfer duty when purchasing the shares in a Company or a member’s interest in a Close Corporation.

- The largest expense when purchasing fixed property is most certainly transfer duty. Transfer duty is a government tax payable to SARS on the transfer of ownership of the property.

- Transfer duty is payable by the Purchaser – except in instances where the transaction is VAT-able – and this could amount to a substantial amount of money. Money which you have to pay over and above the purchase price of the property and money which you can’t claim back from SARS.

- Therefore, to many people, this idea sounds quite appealing. You will furthermore save on time due to the fact that the transfer of the property doesn’t have to be registered in the Deeds Office.

- In the past, there used to be this loophole in the legislation, but since 2002 the option no longer exists – contrary to the belief of many.

- Therefore, since 2002, the purchaser of shares in a residential company (a company that has an asset value of more than 50% in residential property) has to pay transfer duty on the “fair market value” of such property.

- Unfortunately, you will therefore indeed have to pay Transfer Duty!!

Tax- and Estate planning considerations:

- Although no two scenarios are the same, several tax implications arise when owning property in a Company. The rate of Capital gains tax (which is payable on the sale of the fixed property) differs vastly between Companies and individuals. Capital gains tax in the case of Companies is much higher than with individuals.

- Other tax implications like VAT and Estate Duty, may also arise. It is therefore important to obtain proper advice concerning your specific personal circumstances.

Simplicity and costs:

- To own and manage a Company obviously brings about additional costs and administrative complexities. Financial statements have to be drawn up annually and proper accounting records be kept. This implicates additional annual expenses and costs. In terms of the Companies Act, you as Director of the Company will have additional responsibilities and formalities you have to comply with.

- If the property you are purchasing is mortgaged, you will have to deal with these mortgages. This in itself can become a very time-consuming process due to the fact that existing sureties at the Bank will have to be cancelled and new sureties registered in the name of the newly appointed Directors – something that Banks don’t do easily.

- Processes are much easier and simpler when done in your personal capacity than in the name of a Company or CC.

The hidden risks:

- When purchasing the shares in a Company or interest in a CC, you will not only acquire the shares or interest but the entire Company or CC, with all its assets and liabilities, as well as current and future debt. In most cases, the Seller is not known to the purchaser and if all liabilities aren’t declared beforehand, you could run the risk of losing the house if a liability of the Company suddenly appears afterward.

- Undeclared suretyships remain a serious risk. Unfortunately, there is no way to determine beforehand which sureties exist and have been signed and given by the Company to third parties.

- It is very important to properly peruse the financial statements of the Company or CC to determine all creditors of the Company so that you don’t find a nasty surprise afterward.

Again – obtain proper legal advice before putting pen to paper!

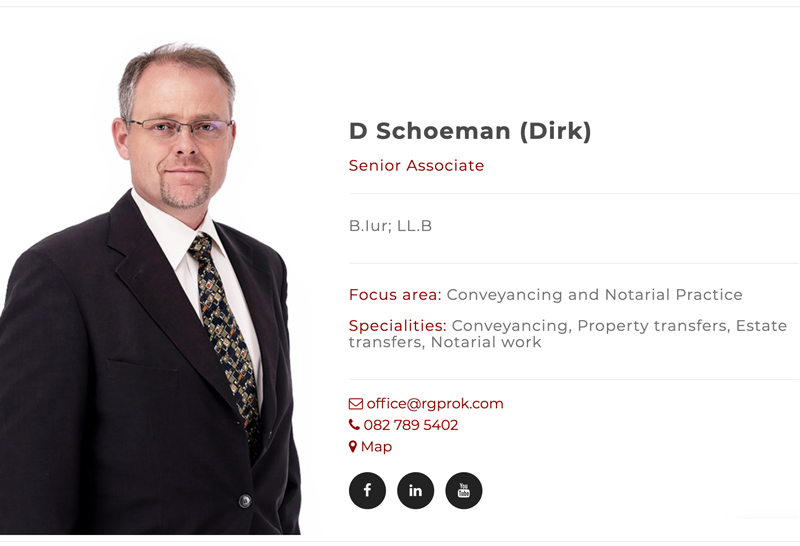

Article by Dirk Schoeman (Senior Associate) – dirk@rgprok.com